Reporting Gambling Winnings On Tax Return

What is a Form W-2G

When most people think about their income, they think about their paychecks, their net business profit, their pension or social security income—the money they’ve worked for and count on every month to pay their bills and cover their expenses. However, not all income is the product of hard work or financial planning, and sometimes a taxpayer can generate income with the flip of a card or the roll of the dice. Lucky lottery players and casino goers likely don’t think about the tax consequences of winning big, but after crossing a certain earnings threshold, those winnings are treated as taxable income.

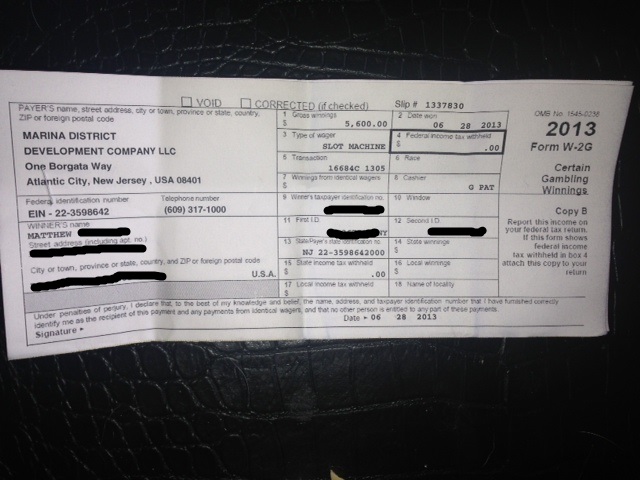

IRS Form W-2G is issued by a casino or payer to taxpayers who have earned above a specific threshold to report gambling winnings. A payer may also send an IRS Form W-2G if it withholds a portion of your winnings for federal income tax purposes.

You can claim a deduction for gambling losses up to the amount of taxable winnings reported on your return. In other words, you must report at least $100 of gambling winnings as income on your tax return to deduct the $100 you spent on losing scratch-off tickets. Specifically, your tax return should reflect your total year’s gambling winnings – from the big blackjack score to the smaller fantasy football payout. That’s because you’re required to report each stroke of luck as taxable income — big or small, buddy or casino. File Form W-2G, Certain Gambling Winnings, to report gambling winnings and any federal income tax withheld on those winnings. The requirements for reporting and withholding depend on the type of gambling, the amount of the gambling winnings, and generally the ratio of the winnings to the wager. File Form W-2G with the IRS.

Do I have to report my gambling winnings to the IRS?

Oct 09, 2020 You must report all gambling winnings as 'Other Income' on Form 1040 or Form 1040-SR PDF (use Schedule 1 (Form 1040 or 1040-SR) PDF), including winnings that aren't reported on a Form W-2G PDF. When you have gambling winnings, you may be required to pay an estimated tax on that additional income.

The IRS treats gambling winnings as taxable income, which must be reported on a tax return. In order to keep track of taxpayer’s gambling winnings, the IRS requires the paying entity (such as the state lotto commission, the casino, or the racing track) to report winnings over a certain threshold.

If a taxpayer wins more than:

- $1,200 from a slot machine or bingo game,

- $1,500 of proceeds from keno,

- $5,000 of proceeds from a poker tournament,

- $600 of winnings from any other game where payout is more than 300 times the wager,

- or any other winnings subject to tax withholding,

then he or she can expect to be required to provide identifying information which allows the paying entity to issue an IRS Form W2G.

Form W-2G Instructions

Form W-2G will request that the taxpayer provide the following information:

- The amount of gross winnings

- The date the winnings were won

- The type of wager that was made

- The amount of federal and state income tax already withheld

When filing his or her tax return, the taxpayer will need to add up all IRS Form W-2Gs received in that year, along with any smaller gambling winnings that may not have triggered an IRS Form W-2G requirement. The taxpayer will also be required to include those earnings as “Other Income” on the first page of his or her IRS Form 1040 return.

Even if you don’t receive a W-2G in the mail before tax season rolls around, you will still be legally obligated to report your earnings on your year-end tax return. Keeping careful track of all of your financial documents, such as wager statements, payment slips, and other gambling receipts, will ensure that you’re able to accurately report your earnings come tax time.

Are gambling losses tax deductible?

Maybe you enjoy gambling, but you’re not always so lucky with your winnings—there is one bit of good news for you. Although you can’t report your net winnings, you can report your gambling losses as an itemized deduction on Schedule A. However, there’s a catch: losses can only be deducted up to the amount of gambling winnings in a given year.

For example, if a taxpayer spends $500 at the casino, and wins $5,000, he or she will only have to pay taxes on the $4,500 of profit, as long as he or she has proof of the $500 spent. On the contrary, if a taxpayer spent $5,000, and only won $500, there will be no extra tax imposed on the gambling winnings, although the extra $4,500 of loss cannot be used to offset any other non-gambling winnings.

Do keep in mind that the IRS will only accept proof if they believe that the taxpayer him or herself actually suffered the losses—IRS rulings have refused to allow loss deductions based on tickets covered in dirt and footprints, as though they had been collected from the ground after another unlucky gambler had dropped them there.

How much tax is already withheld from gambling winnings?

Gambling facilities have the power to withhold part of your winnings for federal tax purposes, however this power depends on the type of gambling activity participated in and the amount of money won. On IRS Form W-2G, the amount already withheld can be found is noted in Box 4, and state and local tax withholdings are noted in Boxes 15 and 17.

To date, there are two types of withholding for winnings from gambling: regular withholding and backup withholding.

Regular Withholding: The payer withholds 25% of your winnings on cash payments where the winnings minus the wager totals to $5,000 or more.

This applies to winnings from:

- Wagering pools

- Sweepstakes

- Lotteries

- Other wagers (if the winnings total at least 3,000 times the amount of the wager)

Note that regular withholding only applies to non-state lotteries, sweepstakes, and wagering pools, and that the withholding rate rises to 33.33% for non-cash winnings.

Backup Withholding: The payer withholds 28% of your winnings earned from keno, bingo, slot machines, and poker tournaments. This typically only applies when winnings total to:

- At least $600 and at least 300 times the original wager,

- At least $1,200 from bingo or slot machines,

- $1,500 from keno,

- $5,000 from a poker tournament.

Reporting Gambling Winnings On Tax Return Filing

Taxpayers may also see their gambling winnings subject to backup withholding if they fail to provide the correct taxpayer identification number to the payer.

Community Tax can assist with your IRS Help and gambling winnings. Contact Community Tax today for a free consultation: (844) 247-2781

We doubt that anyone ever woke up thinking, “Gee, I hope I get audited by the IRS this year”. An IRS audit could easily be one of the worst things that could happen to you this year. So if you want to avoid receiving that ominous letter from the IRS that your 2015 tax return is being audited here are seven red flags you need to totally avoid.

Not reporting all of your taxable income

Those 1099’s and W-2s you received this past January? You weren’t the only one that got them. The IRS got them too. It’s important to make sure you report all of the required income on your return. The computers used by the IRS are pretty darn good at matching the numbers on your return with the numbers on your 1099s and W-2s. If they turn up a mismatch this will create a red flag and the IRS computers will spit out a bill. If those darn computers do make a mistake and you receive a tax form that shows income that wasn’t yours or lists incorrect amounts of income, you will need to get the issuer to file the correct form with the IRS. And what about that income you earned on those side jobs? In most cases you should have received a 1099 documenting your earnings. If not, this is definitely a case where it’s better to be safe than sorry and report it.

Taking deductions that are higher than average

If the IRS spots deductions on your return that are disproportionately large in comparison with your income, it may pull your return for review. For example, a very large medical expense –again out of proportion to your income – could cause a red flag. However, if you do have the documentation to support the deduction then don’t be afraid to claim it.

Claiming really big charitable deductions

Charitable deductions can be a great write off. Plus, when you contribute to a charity it can make you feel all fuzzy and warm inside. However, if those deductions are disproportionately large in comparison with your income, it will raise a red flag. The reason for this is because the IRS knows what is the average charitable deduction for people at your level of income. Did you donate some very valuable property? In this case we hope you got an appraisal for it. Did you make a non-cash donation over $500? Then you better make sure you file form 8283. if you don’t file this form or if you don’t have an appraisal supporting that big donation you’ll become an even bigger target for auditing.

Claiming big gambling losses or not reporting gambling winnings

If you’re a recreational gambler you must report your winnings as “other income” on the front page of your 1040 form. If you’re a professional gambler you will need to report your winnings on Schedule C. If you don’t report gambling winnings this can draw the attention of the IRS – especially in the event that the casino or other venue reported your winnings on form W-2G. It can also be very risky to claim big gambling losses. In fact, what you should do is deduct your losses only to the extent that you report your gambling winnings. For example, if you were to report you had won $5000 gambling but had losses of $20,000, this could cause a red flag. Also, only professional gamblers can write off the costs of meals, lodging and other expenses related to gambling. And the surest way to invite an audit is by writing off what you lost at gambling but no gambling income. If you’ve done any of these things, or are worried about some other common tax return mistakes, it might be wise to file an amended tax return and account for those wins or losses correctly.

Writing off a hobby as a loss

You will dramatically increase the odds of “winning” an IRS audit if you file a schedule C showing big losses from any activity that could be considered a hobby such as jewelry making, coin and stamp collecting, dog breeding, and the like. IRS agents are especially trained to ferret out people who improperly deduct losses associated with a hobby. You must report any income your hobby generated or whatever but can then deduct your expenses up to that income level. But the IRS will not allow you to write off losses from a hobby. So if you want to write off a loss you must be running your hobby as if it were a business and must have the reasonable expectation of generating a profit. As an example of how this works if your hobby generates a profit in 3 out of every 5 years then the IRS will presume that you’re actually in business to make a profit unless it can prove something to the contrary. Of course, if you’re unfortunate and win the audit lottery the IRS will make you prove that you do have a legitimate business and that it’s not just a hobby. So make sure you keep all documents that support your expenses.

If you report income from self-employment of $100,000 or more

Reporting Gambling Winnings On Tax Return Refund

Let’s suppose that you’re self-employed, had a really great year and had earnings of $100,000 or more you are reporting on schedule C. This is likely to trigger an IRS audit because according to the IRS people who file a schedule C are more likely to under report their income and overstate their deductions. What this means is that if you earn $100,000 or more and are reporting it on schedule C you’ll need to make sure you have the documentation necessary to support your deductions and again, make sure you report all your income very accurately.

If you work in certain industries

Reporting Gambling Winnings On Tax Return Late

The IRS knows based on past audit experience that there are certain activities or industries that have a higher incidence of what’s technically called noncompliance but really means cheating on their taxes. Included in this group are the tax returns of air service operators, gas retailers, auto dealers, attorneys and taxi operators. So, if you’re employed in one of these industries or activities and don’t want to suffer an IRS audit, it’s best to follow the old adage that honesty is the best policy.